Thought leadership

Expert commentary on public policy issues which shows how actuaries, as a profession, serve the public interest and use data for good across a wide range of topics.

Our latest thought leadership

Explore the Institute’s thought leadership publications, which show how actuaries, as a profession, serve the public interest and use data for good across a wide range of topics.

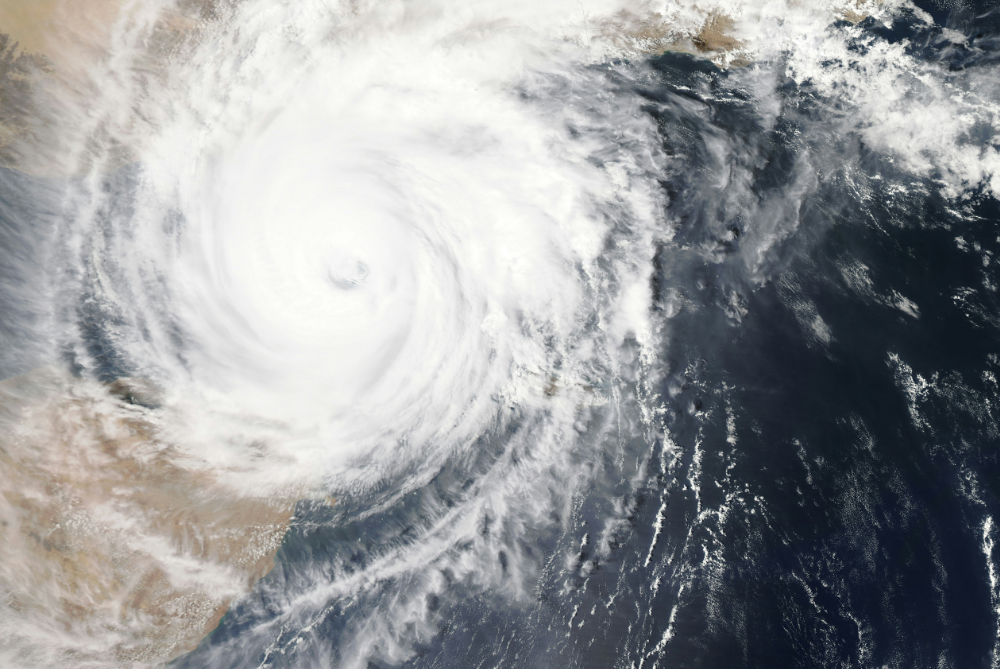

Mobilising Adaptation Report

A Report discussing solutions to the challenges of negative economic and social impacts of climate change and recommendations for valuing, coordinating and financing adaptation investment.

Submissions

Societal issues

General insurance

Data science and AI

Life insurance

Health

Superannuation and investments

Risk management

Climate and sustainability

Share your expertise with the profession - and beyond. Contribute to our thought leadership.