All Actuaries Summit 2026 Program

Explore the complete program schedule to plan your Summit experience.

2026 Program

Scott Reeves, President, Actuaries Institute

As a Fellow of the Actuaries Institute, Scott has extensive experience in actuarial and non-actuarial roles over more than 30 years. Scott was the Head of New Markets and previously Head of Underwriting, Australasia for the Non-Life division at Munich Re for over 12 years where the team built new verticals for the reinsurance division with a clear emphasis on the implications of climate change for financial institutions, along with opportunities in AgTech, and GreenTech. Before that, Scott held broader roles in reinsurance Client Management, business management in the General Insurance sector, and in consulting outside of insurance. Scott has gained valuable cultural experience through working in Australia, Asia and the UK.

Multi-rhythm leadership is the capability to move deliberately between structured planning, iterative learning and real-time sensing.

Leave with practical tools to lead with confidence amid rising costs, natural disasters, climate volatility and rapidly evolving customer expectations.

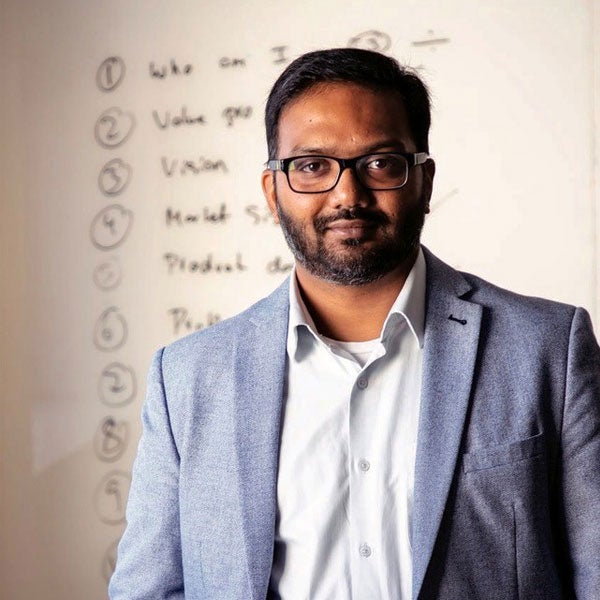

Suhit Anantula, AI Strategy and Human-Centered Innovation Expert

Suhit Anantula is a leading voice on co-intelligent organisations—enterprises that blend human expertise and machine intelligence into adaptive, compound-thinking systems. As founder of The Helix Lab, he works with CEOs, boards and policy leaders to architect AI strategy, build private LLM engines, and redesign organisational decision rhythms across complex environments. Suhit is the author of The Helix Moment and co-author of The Policy Playbook. He is currently writing his next book, The Co-Intelligent Organisation(2026).

Jacki Johnson, Non-Executive Director, Community First Bank

Dr Jacqueline Johnson brings over 30 years’ leadership experience across insurance, regulation and sustainable finance. As CEO of IAG NZ, she rebuilt the business following major seismic events, securing capital, strengthening customer and community trust, and delivering long-term resilience in a high-hazard market. She has held global system-level roles including Co-Chair of UNEP FI and Founding Co-Chair of ASFI, shaping the frameworks that now guide climate, risk and sustainability practices across the financial sector. Jacki is a research fellow at the University of Wollongong, a faculty member with the Cambridge Institute for Sustainability Leadership, and an Non-Executive Director at Community First Bank . Her work focuses on sustainable insurance, climate governance, stakeholder value and system resilience.

Chair: Andrew Matthews, Principal, Finity Consulting

Andrew is a Principal and Actuary at Finity Consulting and an Associate Professor at Monash Business School as well as a PhD candidate at University of Newcastle. He strives to create the conditions for forging ahead by applying actuarial capabilities to surface facts, explore possibilities and initiate collective actions. Andrew specialises in Health Insurance.

Developing an inherently interpretable deep learning model for general insurance pricing is highly desirable, as it enables actuaries to harness the strong predictive power of deep learning while ensuring the model remains commercially viable and transparent. However, building such a model is challenging due to the absence of a universally accepted definition of interpretability. Establishing a rigorous, industry-wide framework to define and assess model interpretability is therefore essential. Moreover, beyond interpretability, various practical considerations (e.g. smoothness, monotonicity) are critical requirements for general insurance pricing models.

This research makes two primary contributions:

1. Interpretability framework for insurance pricing: We establish a rigorous framework that provides a concrete definition and mathematical formulation of interpretable pricing models. The framework articulates how interpretability can be formally expressed and outlines the interpretability and practical requirements that are essential in the insurance pricing context. This serves as a foundation for developing a common standard that can be adopted across the industry to define, design, and evaluate the interpretability of pricing models.

2. Actuarial Neural Additive Model (ANAM): We introduce ANAM, an inherently interpretable deep learning model for general insurance pricing. ANAM integrates the Neural Additive Model with several key enhancements within both its architecture and training process. These features ensure that the model satisfies actuarial interpretability standards while maintaining strong predictive performance and practical applicability.

Comparisons of predictive performance are conducted against both traditional actuarial models and state-of-the-art machine learning techniques using synthetic and real-world insurance datasets. The results demonstrate that the proposed model consistently outperforms alternative approaches in most scenarios while maintaining full transparency in its internal mechanisms, highlighting its strong interpretability and predictive power.

Duc Tu Pho, Munich Re

Tu is an Actuarial Analyst working in the non-life reinsurance industry. He graduated from the University of New South Wales with First Class Honours and was awarded the University Medal for his Bachelor of Actuarial Studies (Honours). Prior to that, he completed a double degree in Actuarial Studies and Data Science at Macquarie University. Tu’s research interests lie in the application of machine learning techniques to general insurance pricing and reserving, with a focus on developing interpretable and practical models for actuarial use.

Patrick Laub, UNSW

Patrick Laub is a senior lecturer at the UNSW School of Risk and Actuarial Studies. His teaching covers artificial intelligence and machine learning courses, with a focus on risk and insurance applications. He holds a PhD in computational applied probability and degrees in software engineering and mathematics. Patrick's research focuses on computationally challenging problems in actuarial data science, with a focus on natural catastrophe modelling and artificial intelligence.

Bernard Wong, UNSW

Professor Bernard Wong is Head of the School, Risk and Actuarial Studies at the University of New South Wales, Australia. He is a Fellow of the Institute of Actuaries of Australia, a Fulbright Scholar, and obtained his PhD from the Australian National University. His current research interests span two interrelated main areas: AI/ML enhanced actuarial methods for risk modelling, and capital modelling for risk and insurance businesses - especially under climate change, dependence, and extremes. Bernard is co-lead of the Innovations in Risk, Insurance, and Superannuation (IRIS) Knowledge Hub, a chief investigator in the UNSW Institute of Climate Risk and Response, and founding member of the Business AI Lab. His research is funded via Australian Research Council Linkage and Discovery Project schemes, and he has been recognised via the award of numerous prizes, including the Melville Practitioner Prize, Hachemeister Prize (twice) and the Taylor-Fry Silver Prize. Bernard has taught most of the courses corresponding to the professional actuarial syllabus, with a particular focus in recent years in the areas in innovations in the areas of actuarial data science, and in quantitative models of enterprise risk management. Bernard is currently on the Board of ASTIN, the non-life insurance section of the International Actuarial Association, and previously also served on the Australian Actuaries Institute Data Analytics (Data Science) Practice Committee.

Key findings from the Australian Actuaries Intergenerational Equity Index (AAIEI) update to 2025

Deeper analysis following the update into the housing domain and the lifecycle of government funding flows by age

Other key research into intergenerational inequity including discussion of the implications and proposed solutions.

The AAIEI (https://tinyurl.com/4tfh6h83 and https://tinyurl.com/y3evt62m) tracks 24 indicators across six broad domains that relate to wealth and wellbeing (Economic and Fiscal, Housing, Health and disability, Social, Education and Environment). The absolute change as well as the relative change is tracked for three age groups. This provides a means to explore changes in intergenerational equity over time. We recently updated the index to 2025 and will highlight key findings.

Alongside the update we carried out analysis into the highly topical area of housing, which is marked by poor affordability, falling home ownership rates and longer durations renting. As one bank CEO recently expressed it “If [the housing market] doesn’t change and you live in Sydney, you’ll never know your grandkids”. By exploring data behind the indicators we will present insights on rental affordability plus home ownership projections. We will discuss findings and relevant policy implications.

A further analysis area was the ‘lifecycle’ view of how money (particularly government money) flows by age; younger age groups receive support (e.g. education), working-aged adults tend to be net taxpayers (taxes paid are greater than government services and benefits, on average), and older people net beneficiaries (e.g. through the age pension). Existing research paints a good picture of this lifecycle. We built on this by updating social spending estimates to capture recent programs (such as the NDIS rollout). We will discuss findings and policy implications for fiscal sustainability over the lifecycle.

The final component of our presentation will cover key research by other authors, the Intergenerational Report, and takeaways for actuaries in terms of policy proposals and reforms to watch for over coming years.

Hugh Miller, Taylor Fry

Hugh Miller is a principal at Taylor Fry. For the past 10 years he has been applying actuarial techniques to social sector problems spanning welfare, employment, housing, disability and health. He has led major pieces of work for the Disability Royal Commission and the NDIS Review and was 2021 Actuary of the Year.

Laura Dixie, Taylor Fry

Laura Dixie is an experienced actuary and a director at Taylor Fry consulting. She works in Taylor Fry’s Government practice using quantitative analysis applied to a range of datasets to understand how people interact with services in the health, disability and social sectors. This often means using linked datasets and statistical analysis to support government in making sustainable decisions that benefit community.

Key Messages

If you have no claims and exposure data, you can get creative in using publicly available data sources. Insurtechs have done this with great success, and you can too.

We will share some tangible examples of creative use cases.

How to supplement industry standard models with non-traditional data to develop your company’s own view of risk.

Jessica Leong, Octogram

Jessica Leong is the CEO of Octagram, an actuarial firm specializing in general insurance pricing. Prior to founding Octagram 4 years ago, Jessica was Head of Data and Analytics at Zurich North America. There, her team build predictive model for commercial general insurance lines across USD$16 billion in premium. From 2020–2021, Jessica was President of the Casualty Actuarial Society in the U.S. and was proud to lead this professional organization serving over 9,000 members. After spending 24 years abroad, Jessica now resides in Melbourne, Australia with her husband and two kids.

Whether it's food delivery, tourism or routine travel; the modernisation of the motor industry brought upon by the increased electric vehicle usage is creating a vastly different operating compared to what has been observed historically. Different road and vehicle laws, licensing, scheme and product design has created significant experience differences between Australian states. This has created unique operating environments in which insurers must navigate.

Personal Mobility Devices are small, electrically powered device and are generally designed for a singular user to travel short distances. They typically include devices such as electric scooters (e-scooters), electric bikes (e-bikes) and electric skateboards (e-skateboards). PMDs have seen increased usage over recent years which can partially be attributed to the ease of access caused by the entrance of shared mobility companies into the market. This has led to PMDs becoming heavily used, particularly in the food delivery industry where delivery drivers leverage them to efficiently navigate urban areas.

PMDs can exhibit vastly different risk characteristics to other forms of conventional transport due to their unconventional design, distinct rider behaviour and different operating environments. Road infrastructure and urban environments, state-based legislation, interactions with pedestrians and other road users and the implementation of telematics all have the propensity to further influence risk profiles creating further complexities for insurers.

With a focus on electric bikes and electric scooters; this paper will look at the impacts that the increasing usage of personal mobility devices are having on the Australian insurance market through a comprehensive review of existing literature and comparison of those findings against local data. As part of this process, we have focused on the different injury frequency and severity experience in a selection of different Australian states and analysing the different factors that may influence them. This includes incorporating the different operating environment that personal mobility devices exist in, including regulation and road rules such as licensing, helmets and speed limits, road infrastructure and insurance regulations and scheme design (i.e. Compulsory Third Party, Workers Compensation).

Lachlan Clark

Lachlan Clark is an actuary with experience spanning a wide range of positions across Australia in both insurance and data analytics. His current role focuses primarily on General Insurance and data analytics projects, where he applies actuarial approaches in both traditional and emerging areas. Lachlan has worked across a wide range of areas including climate risk, banking, workforce and supply chain modelling as well as in reserving and pricing roles for a variety of general insurers both domestic and internationally including supporting audit and appointed actuary roles. He brings a practical, data-driven approach to addressing emerging risks and challenges in the industry.

What are the perspectives of Health Appointed Actuaries in this changing landscape – is the industry and Government focussing in the right areas, or where should we change to support better outcomes? What role are actuaries playing in this sector, and is that enough or can we have more of a positive impact?

Ben Ooi, BUPA

Nicholas Stolk, Finity

Nick Stolk is a consulting health insurance actuary and a Principal in Finity’s Private Health Insurance Practice. He is currently the Appointed Actuary to 8 health insurers, and is celebrating his 21st year of working with Australian health insurers in 2026. In recognition of his coming of age he has gone global, which is to say he is working with a New Zealand health insurer. Nick loves the people, the politics and the purpose of Australia’s not for profit health insurance sector and is happy to discuss the ideas, trends and complexities of Australia's health system with anyone who will listen.

Adam Stolz, Medibank

The discussion is framed around three practical gaps that continue to limit progress: an information gap, a solutions gap, and a funding gap. Better data, modelling, and exposure ownership enable more informed decisions and targeted prevention. A broader toolkit — spanning traditional insurance, structured risk transfer, and alternative reinsurance mechanisms — allows risks to be managed more strategically rather than accumulating on public balance sheets. Finally, access to diversified sources of capital, including insurance-linked and alternative capital, expands capacity and improves affordability. Using examples from global government pools and public-sector risk programmes, the session focuses on how PPPs function in practice, what design choices matter, and how these lessons can inform Australian debates on resilience, funding, and risk sharing. The objective is practical: to move from analysis to execution, and from fragmented responses to coordinated solutions.

Bo Jiang, Swiss Re

Current industry practice relies heavily on Pearson’s correlation coefficient, which has well-known limitations. Correlation captures only linear association (Embrechts et al., 2002), meaning two variables can be dependent yet have zero correlation. It is also restricted to measuring pairwise associations (McNeil et al., 2015), and many actuarial models involve more than two random variables. Because pairwise dependence properties do not naturally extend to the multivariate case, the sole use of correlation is intrinsically limiting. For example, correlation will fail to identify a situation where variables are pairwise independent but mutually dependent. This is problematic because many fundamental results − including Central Limit Theorems (CLT) which are pervasive in many applications − often fail under sole pairwise independence (e.g., Avanzi et al., 2021; Boglioni Beaulieu et al., 2021).

In this paper, we explain how distance correlation (Székely and Rizzo, 2009) and Hellinger correlation (Geenens and Lafaye de Micheaux, 2020) address the aforementioned issues and can hence be used as a powerful tool in actuarial applications. Those measures are defined on interpretable distances and are remarkably zero if and only if two variables (or vectors in the case of distance covariance) are independent.

A number of extensions of those measures have been developed in the statistical literature, and we discuss how these can be applied in actuarial practice. For example, joint distance covariance (Chakraborty and Zhang, 2019) captures mutual dependence among more than two random vectors (e.g., multi-line capital aggregation). Auto- and cross-distance correlation (Zhou, 2012) can be used in time series analysis (e.g., claims or mortality), while partial distance covariance (Székely and Rizzo, 2014) can help test conditional independence or guide variable selection (e.g., pricing models).

These new tools offer a robust framework for detecting and modelling nonlinear and higher-order relationships in data, and can help strengthen the reliability of actuarial applications. As global risks become increasingly interconnected − for example, through the effects of climate change − dependencies between risks are likely to strengthen and become more complex. The paper takes particular care in illustrating these concepts in an actuarial context and aims to provide a practical toolkit to those actuaries who may wish to use them in their own practice.

Ho Ming Lee, Title and Organisation

Ho Ming Lee is currently a PhD candidate in a joint PhD program between the University of Melbourne, Australia, and KU Leuven, Belgium. He completed a Master’s degree in Actuarial Science and a Bachelor of Science, majoring in pure mathematics, at the University of Melbourne. His current research focuses on fairness considerations in actuarial applications, spanning both theoretical and machine-learning work.

Katrien Antonio

Katrien Antonio is full professor in actuarial science at KU Leuven (Belgium) and part-time professor in actuarial data science with the University of Amsterdam. She teaches (BSc, MSc) courses on life insurance mathematics, loss models, and data science for insurance. Her research puts focus on insurance data science, with applications in insurance pricing, reserving and stochastic mortality modelling. Her work has been published in actuarial journals (e.g., ASTIN, IME, North American Actuarial Journal, Scandinavian Actuarial Journal), in statistics and OR journals. Currently, Katrien serves as vice-dean for education and students at the Faculty of Economics and Business (FEB) at KU Leuven.

Benjamin Avanzi, University of Melbourne

Benjamin Avanzi, PhD, Actuary SAA, GAICD, CERA, FIAA, is Professor of Actuarial Studies at the University of Melbourne. He has worked as an actuarial consultant in Switzerland and Canada, served as the Executive Chairman of the Board for a Swiss pension fund from 2006 to 2008, and has held full-time academic positions in Australia and Canada since 2008. Along with various co-authors, he has been awarded the Hachemeister Prize twice by the Casualty Actuarial Society, in 2017 and 2023, the Taylor Fry General Insurance Seminar Silver Prize in 2018, a Highly Commended Paper Prize from the Institute and Faculty of Actuaries in 2022, as well as both Melville and Carol Dolan All Actuaries Prizes in 2025. He is an Editor of the ASTIN Bulletin: The Journal of the International Actuarial Association and an Associate Editor of the journal Insurance: Mathematics and Economics.

Guillaume Boglioni Beaulieu, UNSW

Guillaume Boglioni Beaulieu is an Education-Focused Senior Lecturer in the School of Risk and Actuarial Studies at UNSW Sydney. He previously served as Lecturer at Macquarie University (2022-2024) and Associate Lecturer at UNSW (2020-2022), where he also completed his PhD in Actuarial Studies in 2023. He holds a Master’s degree in Statistics (2017) from the Université de Montréal. Guillaume’s research interests lie in probability theory, independence testing and dependence modelling, with particular focus on actuarial applications. His contributions include counterexamples to classical central limit theorems under weaker notions of independence.

Pierre Lafaye de Micheaux

Pierre Lafaye de Micheaux is a Canadian/French/Swiss statistician specializing in mathematical and applied statistics. He completed postdoctoral fellowships at the Centre de Recherches Mathématiques in Montréal and McGill University’s Brain Imaging Center before becoming Assistant Professor at Grenoble Alps University in 2003. After serving as Affiliate Researcher at the Grenoble Neuroscience Institute, he joined Université de Montréal in 2009, where he became Associate Professor in 2011. He later held positions at UNSW Sydney, CREST-ENSAI, and Université Paul Valéry, and was promoted to Associate Professor at UNSW in 2020. His research spans dependence measures, (neuro)imaging genetics, and data science, with contributions to R package development and industrial applications in machine learning and deep learning. He co-leads three research groups on dependence measures, imaging genetics, and IoT/data science.

This presentation demonstrates how actuarial teams can integrate customer-centred thinking into product design by analysing these behavioural signals through the lens of 3–4 illustrative customer personas—each reflecting a segment commonly targeted by health insurers’ sales and marketing teams. Using de-identified insurer data, we trace how product selection, claim patterns, and policy changes reveal unmet needs, misaligned incentives, and opportunities for better benefit design and communication.

We will also critically examine the current hospital product classification tiers (Gold, Silver, Bronze, Basic) and suggest opportunities for policymakers from an actuarial perspective.

Caitlin Fowlds

Caitlin Fowlds is a qualified actuary specialising in the Private Health Insurance sector. She has a strong passion for applying actuarial insights to improve the quality and affordability of healthcare in Australia. Caitlin holds a Bachelor of Actuarial Studies (Co-op stream) from Macquarie University and is a Fellow of the Actuaries Institute. She began her career in consulting and is now an Actuary at HCF, where she focuses on pricing, benefit costing and product design.

Nicholas Stolk, Finity

Nick Stolk is a consulting health insurance actuary and a Principal in Finity’s Private Health Insurance Practice. He is currently the Appointed Actuary to 8 health insurers, and is celebrating his 21st year of working with Australian health insurers in 2026. In recognition of his coming of age he has gone global, which is to say he is working with a New Zealand health insurer. Nick loves the people, the politics and the purpose of Australia’s not for profit health insurance sector and is happy to discuss the ideas, trends and complexities of Australia's health system with anyone who will listen.

Juanita Jamsari, Finity

Juanita is a qualified actuary specialising in Australia’s private health insurance sector. She is a Senior Consultant at Finity with 10 years of experience in private health insurance, having worked with 25 health insurers, industry bodies, and the Department of Health, Disability and Ageing. She is also a member of the Gold Hospital Working Group at the Institute of Actuaries of Australia.

We develop a unified framework that grounds fairness testing in classical statistical inference, providing clear definitions, reproducible methods, and auditable protocols.

Our framework advances fairness testing along four key dimensions. First, we formalise widely discussed fairness criteria that can be potentially applied to insurance pricing contexts as hypotheses on identifiable estimands, making fairness notions statistically precise. Second, we introduce decision rules that incorporate explicit tolerance thresholds, reflecting regulatory standards in practice. Third, we propose inference procedures, bridging actuarial practice with fairness guarantees. Fourth, we design a quote-audit protocol that specifies how to collect, test, and validate fairness claims in a manner that is transparent and replicable.

By combining inferential rigour with regulatory practicality, our approach delivers a coherent methodology that both regulators and insurers can implement. The framework integrates uncertainty quantification and audit design into a single pipeline, ensuring that fairness tests are interpretable, reproducible, and statistically robust. Beyond pricing, the principles can be extended to approval outcomes and process measures, providing a flexible foundation for responsible insurance analytics. The result is a regulator- and insurer-ready toolkit that aligns fairness testing with statistical guarantees and supports the broader goal of accountable and transparent insurance practices.

Fei Huang, UNSW

Dr. Fei Huang is an Associate Professor in the School of Risk and Actuarial Studies at UNSW Business School. She is also a columnist for Actuaries Digital, writing Responsible Data Science series. Her research focuses on responsible AI and data-driven decision-making, with applications in fair insurance pricing, interpretable machine learning, mortality modelling, and customer relationship management. Her research has been published in leading actuarial journals and has received many prestigious recognitions, including the North American Actuarial Journal Best Paper Award, ASTIN Colloquium Best Paper Award, the Australian Business Deans Council (ABDC) Award for Innovation and Excellence in Research, and fundings from the Australian Research Council (ARC), Society of Actuaries, and Casualty Actuarial Society.

Giles Hooker, University of Pennsylvania

Giles Hooker is Professor of Statistics and Data Science at the University of Pennsylvania. His work has focussed on statistical methods using dynamical systems models, inference with machine learning models, functional data analysis and robust statistics. He is the author of Dynamic Data Analysis: Modeling Data with Differential Equations and Functional Data Analysis in R and Matlab.

This presentation draws on collaborative research led by the GIPC Injury and Disability Working Group, with support from the Young Data Analytics Working Group (YDAWG) of the DSAIPC. Through surveys and consultations with scheme actuaries, administrators and digital strategy leads, we map current and emerging uses of generative AI across Australian, NZ and Canadian injury and disability schemes, particularly citing case studies and pilots schemes are deploying. Further, we consider what future advancements in AI may look like for these schemes

In exploring this evolution, key focus areas include:

Scheme Processes

How schemes are deploying or trialling generative AI in real-world contexts — for example, automating claims correspondence, summarising medical reports, enabling customer service interactions, and improving triage for psychological and complex injuries.

Operational Benefits

Ways AI is increasing internal efficiency, easing administrative burdens on case managers, and enabling faster, more informed decisions, particularly in high-volume or high-complexity areas of claims management.

Fraud Detection and Analytics

How generative AI and natural language models are informing predictive analytics, detecting anomalies, and synthesising disparate claim data to support governance and financial sustainability.

Challenges and Guardrails

Consideration of risks and limitations, including data privacy, ethical use, regulatory expectations, bias in large language models and the essential role of human oversight.

Actuarial Involvement and Leadership

Actuaries work across centrally managed and privately underwritten schemes, regulators, consultants, case management providers and rehabilitation specialists. They are increasingly shaping AI strategy — from designing use cases and assessing data readiness to evaluating performance and fairness. This moment offers a uniquely actuarial opportunity to apply rigour, influence governance, balance financial and social outcomes, and guide AI-enabled redesign of scheme models.

Future Outlook

We explore how early successes and emerging lessons, both within schemes and in broader industries, can help actuaries and scheme leaders design more adaptive and client-centred models that support early intervention, enable tailored recovery pathways, and improve data sharing across compensation, health and employment systems — enhancing both social and economic resilience.

This presentation will equip injury and disability scheme professionals with a balanced understanding of how generative AI can be further leveraged to move its use from beyond hype, to become a powerful enabler of sustainable, client-centred schemes. It will also highlight key opportunities for actuaries to lead in this space, by applying actuarial rigour, advancing ethical data use, demonstrating strategic foresight and contributing to the long-term social and financial sustainability of schemes.

Nicole Appleton

Niki is a qualified actuary with over 25 years of consulting and advisory experience. She combines her strong technical analytic skills with stakeholder engagement expertise and commercial acumen to understand issues clients face and then work with them to develop value adding solutions. Niki has worked on projects across a number of industry sectors including general insurance and injury schemes to community clubs and government social policy. She is a member of the Institutes Injury and Disability working group, s sub-section of GIPC.

Meg Yang, Finity

Meg Yang is a Fellow of the Actuaries Institute and volunteers as the Deputy Chair of the Young Data Analytics Working Group and member of the Data Science and AI Practice Committee. In her role as a consultant at Finity Consulting, she is passionate about harnessing cutting‐edge AI tools to deliver innovative, practical solutions that tackle everyday challenges in the general insurance space.

Australia provides a rare natural experiment: individuals under 65 with disability may access the National Disability Insurance Scheme (NDIS), which offers flexible, need-based funding. After 65, new applicants are eligible only for standardised, means-tested aged care packages. This age cutoff creates a clear contrast in support intensity, flexibility, and incentives for maintaining health, function, and financial independence. We exploit the age-65 threshold in a fuzzy regression discontinuity design with the staggered NDIS rollout, implementing a difference-in-discontinuities framework. This approach enables credible causal identification in a setting with dynamic, long-term outcomes and staggered policy exposure, a combination rarely studied in health economics.

Using population-level linked administrative data containing social services, census, and tax records (PLIDA) from 2011 to 2024, we follow individuals just below and above the cutoff across outcomes. Our study population draws from 1.4 million individuals aged over 65 accessing care support. Our treatment group consists of 39,000 NDIS recipients currently aged over 65, while our primary control group consists of 275,000 participants of the Home Care Packages Program.

We compare discontinuities across granular regions and rollout periods to isolate the effect of early, flexible support from age-related trends and confounders. We also examine heterogeneity by baseline functional capacity, gender, and disability type, and test robustness to alternative bandwidths, placebo cutoffs, and pre-trend specifications.

This research informs Australian policy on life-course investment and provides insight into key normative trade-offs in social care reform, including balancing upfront investment with downstream savings, fairness with fiscal sustainability, and flexibility with standardisation.

Maathu Ranjan

Maathu Ranjan is a senior public servant, actuary, and Sir Roland Wilson Scholar at ANU’s Crawford School of Public Policy. She has held leadership roles in the Australian Public Service and brings expertise in economics, data analytics and evidence-based policy. Maathu is currently the Senior Vice President of the Actuaries Institute Australia and an award-winning researcher, having held appointments at the University of Oxford, the Australian National University, and the University of New South Wales. She is passionate about inclusive systems and the use of rigorous evidence to drive strategic decision-making and long-term social impact.

Melissa Yan, EY

Scott Duncan, Taylor Fry

Scott is a Principal at Taylor Fry and is a member of the General Insurance Practice Committee. He holds several appointed actuary roles across Australia and New Zealand. Scott has a keen interest in how technology is shaping medical practice and the flow on impact on medical indemnity insurers. He has worked with a range of public and private sector medical indemnity providers across pricing, reserving and capital management.

For the purposes of assessing experience, extracting useful operational insights and updating assumptions, there is often much focus on the central estimate and less emphasis placed on the distributional information. Common methods of hindsight analysis tend to compare actual outcomes to point predictions rather than an explicit range from the loss distribution. Actuarial judgement is then often used to justify the materiality of differences and determine whether changes in methodology/assumptions are warranted.

We propose a simple framework to supplement hindsight analysis and judgement using the (often already available) forecast distribution. This approach provides valuable additional information by granting a richer understanding of the range of possible outcomes. It inherently accounts for the variability of the predicted estimate and allows quantification of how outlying each new observation is, based on the characteristics of the line of business such tail length, portfolio size and large claims volatility. In this paper, we will demonstrate how this information can be readily constructed from work already done in deriving the risk margins/adjustments.

Our proposed framework applies established metrics from the field of probabilistic forecasting to assess the distributional performance of actuarial valuations, through a process that integrates easily with standard actuarial valuation pipelines. This information could be used in a number of practical applications, such as experience monitoring, a trigger for reassessment of risk margins/adjustments or as a tool to evaluate the appropriateness of the current valuation assumptions.

By integrating probabilistic forecasting into actuarial valuations, actuaries can move beyond mean-based comparisons towards a more robust examination of emerging data. This will strengthen evidence-based decision making, and will provide a more holistic, quantitative view of how our models are playing out in practice.

Alan Xian, Taylor Fry

Alan is a manager at Taylor Fry Consulting and has worked across many areas including government and corporate analytics, general insurance and injury schemes. He is also an Adjunct Lecturer in the School of Risk and Actuarial Studies at UNSW, lecturing in actuarial courses while conducting research in the areas of data analytics, general insurance and teaching analytics. Alan has a keen interest in contributing to climate discussions and currently serves as the Secretary of the Actuaries Institute Climate and Sustainability Practice Committee.

Calise Liu, Finity

Calise is an actuary with ten years of experience at Finity Consulting. She works in a range of general insurance areas including climate risk, long-tail reserving, pricing and data analytics. She is a co-author of the three Actuaries Institute reports on Home Insurance Affordability in Australia. Calise was awarded ANZIIF’s Young Insurance Professional of the Year in 2023.

Andrew Song, Taylor Fry

Andrew is an experienced actuary at Taylor Fry Consulting Actuaries, leading the day-to-day operations of several Appointed Actuary engagements for Australian insurers and reinsurers, and is the Approved Actuary to a large Australian corporate self-insuring its workers compensation risks.

The federated governance model empowers business units to act as data product owners and stewards, while a central data team provides reusable assets, quality standards, and semantic consistency. This approach enables scalable self-service reporting through enterprise-grade Power BI templates, governed semantic layers, and a shared understanding of metrics. By embedding roles such as data custodians and stewards, and aligning them with business accountability, the organisation fosters a culture of trust, transparency, and shared responsibility.

We also demonstrate how medallion architecture — with bronze (raw), silver (cleansed), and gold (business-ready) layers — supports modular, auditable, and performant data pipelines. Combined with data mesh principles, this architecture decentralises data ownership while maintaining interoperability and governance, enabling rapid delivery of insights without compromising quality or compliance.

This paper offers a blueprint for actuaries, data leaders, and regulators seeking to build resilient, scalable, and future-ready data ecosystems. It highlights how governance, architecture, and culture must evolve together to support advanced analytics, AI readiness, and strategic foresight in complex organisations.

Rohan John, LeavePlus

Rohan John is a strategic data and analytics leader with a rare ability to bridge actuarial science, artificial intelligence, and enterprise architecture. With experience across insurance, disability, government, and regulatory sectors, Rohan has led high-impact transformations that align data capability with corporate strategy and long-term organisational goals. Currently leading the Data and Analytics function at LeavePlus, Rohan has architected and delivered a modern, cloud-native data ecosystem using Microsoft Fabric and medallion-layered design. His work has enabled scalable self-service reporting, certified datasets, and semantic modelling, while embedding federated data governance that empowers business units to take ownership of their data. This approach has uplifted enterprise data maturity and positioned the organisation for AI readiness and decision intelligence. Rohan’s technical expertise spans predictive modelling, natural language processing, segmentation, and traditional actuarial methods such as reserving and financial forecasting. He has built AI-powered tools to support customer service, operational efficiency, and strategic planning, and is known for translating complex analytics into clear, actionable insights for executives and boards. Beyond delivery, Rohan is a passionate advocate for ethical analytics, data literacy, and capability uplift. He builds high-performing teams, drives cross-functional collaboration, and designs data ecosystems that are secure, scalable, and strategically aligned. His career reflects a commitment to solving real-world problems through data — with a focus on impact, integrity, and innovation.

For example, behavioural models may be integrated with data analytics to allow insurers to better understand the drivers of health-related behaviours among their members. With increasing amount of data collected outside of the insurance itself, such as from wearables, affiliated clinics and sponsored events, patterns and triggers may be monitored and analysed to encourage toward healthier behaviours. Predictive modelling also helps to identify claims leakage and informs the development of more robust claims rules to prevent future losses. Additionally, by forecasting claims volumes and complexities, predictive modelling supports more effective workforce planning, ensuring resources are aligned with expected demand. Also, analytics-powered lifetime value (LTV) models uncover attributes of high-value policies, guiding acquisition and retention strategies. Insurers can embark on a data-driven approach to tailor marketing and engagement efforts more effectively.

Ying Ying Tan, WTW

Ying Ying is a qualified actuary with around 15 years of actuarial experience specialising in financial reporting and capital management for both life and health insurance. Prior to joining WTW, Ying Ying had taken on an extensive range of actuarial roles and projects across corporate and consulting settings: •Solvency II team lead for Prudential BSN, Malaysia for 2015/2016 reporting; •Set up the first internal target capital framework under the local capital regime for Prudential BSN, Malaysia and nib health funds, Australia; •Was part of the project team for the life annuity scheme (CPF LIFE) and national health scheme (MediShield) in Singapore during her tenure with Deloitte Australia; •Was part of the project team providing advices to the Australian Government on the Private Health Insurance Reforms in Australia during her tenure with Deloitte Australia.

Kylie Chen, WTW

Over 15 years of financial services experience in London, Australia and Asia Pacific with expert knowledge in general insurance pricing, data analytics and risk management. Before joining WTW, Kylie worked for IAG and Suncorp in Australia cross both personal and commercial line pricing teams. She also worked for Deloitte and Ernst & Young in London in their advanced analytics and actuarial teams. Kylie is experienced in managing and delivering large complex insurance and technology transformation projects in Australis and other Asia pacific regions. She is passionate in using data analytics and latest technology to help businesses to make better decisions.

In this paper, we will provide an update on the state of the MI market in Australia and overseas. We will highlight key risk and market trends, drawing on publicly available data and resources as well as the authors’ professional experience with MI. The intention is to provide a comprehensive review of the last decade or so in the market and how it continues to evolve alongside medical and legal sector trends. We will identify the key issues and opportunities likely to shape the MI market over the years ahead.

Actuaries working with MI will directly benefit from a concise summary of the MI sector, which is generally not publicly available or regularly updated given the specialised nature of MI. General insurance actuaries more broadly will be exposed to a class of insurance which most do not deal with on a regular basis, which will hopefully spark greater interest and further expertise by the actuarial profession.

The healthcare sector was under the spotlight during the recent global pandemic and healthcare crisis, and given the important role MI plays in the sector, this presentation will also be of significant interest to actuaries outside general and health insurance. As the nature of medicine and the legal environment continues to rapidly evolve, MI provides a solid area where actuaries can help society navigate risk and continue delivering in the public interest.

David Chan, VMIA

David is the Head of Actuarial Services for Victoria’s State insurer, VMIA. VMIA insures the State of Victoria for its general insurance needs, including Medical Indemnity for Victoria’s public hospitals and health services. In this role, David leads the pricing, reserving and capital management advice to VMIA’s Board and management. <br><br>Prior to joining VMIA, David was a senior consulting actuary, providing statutory, strategic and analytics advice and support to general and health insurers in Australia, New Zealand and Singapore.

Win-Li Toh, Taylor Fry

Win-Li is a Principal and Actuary at Taylor Fry, and the 2025 President of the Actuaries Institute. She is the Appointed Actuary to several Australian and New Zealand insurers and reinsurer, and advises self-insurers as well as publicly underwritten schemes. Win-Li’s medical indemnity experience spans 20+ years, advising the provisional liquidator in the successful recapitalisation and set-up of the actuarial function for Avant in the early 2000s, and subsequent expert advice to medical indemnity providers in both the private and public sectors, in areas such as merger negotiations, capital management, reserving and pricing. Win-Li wrote the paper “Medical Indemnity- Who’s Got the Perfect Cure?” that explored medical indemnity in major international jurisdictions and the transferability of innovations to Australia.

Scott Duncan, Taylor Fry

Scott is a Principal at Taylor Fry and is a member of the General Insurance Practice Committee. He holds several appointed actuary roles across Australia and New Zealand. Scott has a keen interest in how technology is shaping medical practice and the flow on impact on medical indemnity insurers. He has worked with a range of public and private sector medical indemnity providers across pricing, reserving and capital management.

Jin Cui, TAL

Jin is a qualified actuary with experience in Life Insurance and Data Science. He’s currently a Senior Manager of Data Science at TAL. <br><br>Jin loves to apply a blend of data science and statistical techniques to solve complex business problems, as well as help drive innovation, growth and partnership opportunities.

Through compelling case studies, discover how actuarial expertise in reserving, capital allocation, risk management, and profitability enhancement is reshaping the insurance landscape. These stories highlight actuaries as catalysts and not inhibitors of change and growth.

We will discuss how actuaries leverage their skills in reserving, pricing, underwriting, operations, and performance monitoring to provide insights that fuel business growth and resilience. By integrating their knowledge with financial metrics and narrative building, actuaries empower organizations to navigate challenges and seize opportunities.

This talk will inspire actuaries to embrace their role as strategic partners in the non-life insurance domain, fostering innovation and resilience. Attendees will gain a renewed understanding of how actuaries are shaping the future of non-life insurance for sustainable success.

Join me to explore the transformative potential of actuarial science in non-life insurance and embark on a journey toward strategic excellence.

Ryan Boyd, Allianz

Diffusion models are a common deep learning approach, particularly in image generation. Starting with random variation, a trained model will successively ‘de-noise’ a dataset until it resembles something coherent. In many cases they outperform other model structures, including in a small number of research papers testing applicability to tabular data. Our paper will apply diffusion models to key actuarial problems. The work will build on our 2025 summit paper on deep learning models – we test an entirely new way to set up and train the deep learning model (a diffusion framework), while also significantly broadening the range of applications of our work. In addition to microsimulation and time series problems previously explored, we will test diffusion models’ applicability to reserving contexts. The paper will cover simulated and real-life data examples.

The models represent an important contribution, with the potential to massively simplify the training of complex systems. To the author’s knowledge, this is the first time such diffusion models have been applied in an actuarial context.

Hugh Miller, Taylor Fry

Hugh Miller is a principal at Taylor Fry. For the past 10 years he has been applying actuarial techniques to social sector problems spanning welfare, employment, housing, disability and health. He has led major pieces of work for the Disability Royal Commission and the NDIS Review and was 2021 Actuary of the Year.

Callum Sleigh, Taylor Fry

Callum Sleigh is a manager at Taylor Fry who specialises in data science applications in public policy. Callum graduated with a PhD in Mathematics from the University of Melbourne and has worked in a range of positions in academia and government.

Justin Sik Kwok Wong, Taylor Fry

Justin Sik-Kwok-Wong is a manager at Taylor Fry and has over 5 years of experience advising government clients, regulators and self-insurers. Justin graduated from UNSW with a Bachelor of Actuarial Studies and became a Fellow of the Institute of Actuaries in 2021.

Understanding the why, or the cause and effect is challenging, there are techniques and methods to illuminate the hidden causal relationship, randomized controlled trial (RCT) is often considered as the gold standard for uncovering causality, as it directly addresses the problem of endogeneity by ensuring treatment assignment is exogenous, while other causal methods such as differences-in-differences, regression discontinuity, or instrumental variables arguably suffer from the endogeneity problem to various degrees.

RCT, as a method of field experiment, generates meaningful data, sharper insights and business guidance beyond observational data can provide, it adds to actuaries toolkit and redefines our understandings of why things happen. This presentation will cover common causal inference methods, endogeneity problem, motivations and pitfalls of RCT and a case study of field experiment, which hopefully will inspire more actuaries to explore and embrace the spirit of experimentation.

Laura Zhao, Zurich Cover-More

Laura is a qualified actuary, a Senior Underwriter at Zurich Cover-More, and a part of the Executive Leadership Team within Freely, where she leads advanced pricing strategies and analytics solutions to drive measurable business outcomes. She also has a keen research interest and is an award recipient of the National Industry PhD program.

Fei Huang, UNSW

Dr. Fei Huang is an Associate Professor in the School of Risk and Actuarial Studies at UNSW Business School. She is also a columnist for Actuaries Digital, writing Responsible Data Science series. Her research focuses on responsible AI and data-driven decision-making, with applications in fair insurance pricing, interpretable machine learning, mortality modelling, and customer relationship management. Her research has been published in leading actuarial journals and has received many prestigious recognitions, including the North American Actuarial Journal Best Paper Award, ASTIN Colloquium Best Paper Award, the Australian Business Deans Council (ABDC) Award for Innovation and Excellence in Research, and fundings from the Australian Research Council (ARC), Society of Actuaries, and Casualty Actuarial Society.

Actuarial science offers a unique capacity to translate complex population health risks into long-term fiscal and operational insight. This paper explores how state-of-the-art actuarial analytics—including dynamic risk-adjustment, scenario simulation, AI-enhanced forecasting, and value-based funding models—can reshape decisions on healthcare funding, prevention, and care delivery. We highlight the integration of prevention economics into actuarial frameworks to quantify the productivity dividends of healthier populations.

Drawing on comparative insights from Australia, the U.S., and India, the session illustrates how diverse systems embed value-based care principles within their financing frameworks. Case studies demonstrate how actuarial modeling can guide optimal resource allocation across prevention, primary, and aged care—quantifying not only costs but future capacity, workforce resilience, and system adaptability.

Ultimately, the recalibration of the health economy is more than budgeting; it is a test of societal foresight. By aligning actuarial models with public health and economic objectives, funding systems can be redesigned to reward long-term outcomes over short-term expenditure, helping Australia power a more sustainable and resilient economic future. This session provides a practical framework for actuaries to become central architects in this recalibration, equipping them to convert health data and AI-driven insights into strategic intelligence.

Ankit Nanda

Ankit Nanda is Manager of Actuarial Advisory Services at a large U.S.-based health insurance carrier and resides in Gurugram, India, where he leads a team of analysts and consultants supporting U.S. healthcare clients. With nearly 13 years of experience across reinsurance, employer stop loss, managed care, and consulting, he brings a distinctive cross-border perspective to actuarial practice. Ankit is a Fellow of the Society of Actuaries, a Member of the American Academy of Actuaries, and a Member of the Conference of Consulting Actuaries. He serves on several professional committees, including the American Academy of Actuaries Health Care Delivery Committee, the Society of Actuaries India Committee, and the Institute and Faculty of Actuaries Mental Health Working Party. His research spans both U.S. and Asian healthcare markets, with recent work focused on emerging risks in health insurance—such as GLP-1 coverage frameworks and value-based care models—topics increasingly relevant to the evolving global insurance landscape. He holds an M.S. in Mathematical Finance from Boston University.

Laughlin recognised that Boards occupy a unique vantage point for ensuring fair customer treatment, and identified fairness as a "natural area of interest" for actuaries. But what are the obligations and rules of fairness which apply to general insurance actuaries? This paper examines what practitioners need to know about fairness and what they could, or should, be doing to achieve this objective in practice.

While Laughlin noted that Boards benefit from sitting "above the fray" with greater objectivity than management, this paper argues that general insurance actuaries are equally well positioned—if not better placed—to balance competing interests. Working in the front lines where pricing, underwriting, and claims decisions are made, general insurance actuaries can serve as vital arbiters of fairness, translating principle into practice where it matters most.

Brett Ward, Group Chief Actuary, IAG

Brett Ward is currently the Group Chief Actuary of IAG. Brett has spent his entire 30 plus working years as a general insurance actuary. From 1990 to 2000, Brett worked with actuarial consultancies including MIRA Consultants and KPMG Actuaries focusing on liability valuations, specialising in workers compensation. In 2000 he started his corporate career as the Chief Actuary at Royal & Sun Alliance, where he had responsibility for actuarial services in Australia and South-East Asian countries. Brett was the Chief General Insurance Actuary for Promina before joining IAG in 2007. At IAG, Brett has held a variety of roles across pricing, risk and technology and Group strategy.

Jacqui Reid, Actuarial Educator, General Insurance

Jacqui has extensive actuarial consulting experience across the UK, Ireland, Sweden, Finland, Bermuda and Switzerland. Her Australian experience includes leading a small actuarial team based in Sydney and Melbourne advising corporates, scheme Actuary for NT WorkSafe, developing a pricing model for a private health insurer and developing an operational risk measurement model for a major Australian bank. Jacqueline has also held the roles of past convenor of Actuaries Institute General Insurance Risk Appetite working party, past member of GIPC and past member of RMPC. In 2021 she joined the Institute’s education team to develop and deliver the General Insurance Applications subject.

Tim Clark, Allianz

Alix Pearce, General Manager, Climate, Social Policy and International Engagement, Insurance Council of Australia

Alix is the General Manager, Climate, Social Policy and International Engagement at the Insurance Council of Australia, drawing on the industry’s critical role in the economy to drive down climate risk and better protect communities. Alix’s leadership has been recognised with numerous awards, including a prestigious Churchill Fellowship to travel around the globe in 2025, exploring how to tackle the insurance protection gap being widened by worsening disasters. She has a history of building unique alliances to drive change, her career has seen her work with global security leaders, first-responders, front-line communities, consumer groups, major companies and all tiers of government. As the Head of Campaigns for the Climate Council, Alix led the organisation's advocacy and government relations team, focused on driving down emissions this decade. As the Director of Policy and Campaigns for the Consumer Action Law Centre, she led a team of policy professionals, and campaigners in the wake of the Banking Royal Commission. She also worked as the Founder and Director of the Cities Power Partnership, the biggest climate and energy program for cities in the country. She is also a published author, working with Australia’s premier climate experts, economists and policy analysts on landmark reports that have shifted the national conversation.

Rade Musulin, Principal, Finity Consulting

Rade Musulin is a Principal at Finity Consulting in Sydney, specialising in extreme events and climate risk. He previously held senior roles at FBAlliance Insurance, Aon Benfield Analytics, and Florida Farm Bureau Insurance Companies. Rade chairs the International Actuarial Association's Climate and Sustainability Committee and serves on the Actuaries Institute's Climate and Sustainability Practice Committee. He was named co-winner of the Actuaries Institute's Actuary of the Year (2023) and received the American Academy of Actuaries' Jarvis Farley Service Award (2025). His main areas of interest include how changing population demographics affect catastrophe exposure, climate change adaptation, applications of catastrophe models for disaster planning in developing countries, building code development, and community resilience.

Chair: Christa Marjoribanks, CFO, Intermediated Insurance Australia Division at IAG

Christa is CFO of the Intermediated Insurance Australia Division at IAG, overseeing pricing, strategy, regulatory and risk governance, finance, and actuarial reserving. A key leadership team member since 2020, she has driven improved financial performance through enhanced pricing sophistication and data-led insights. Previously a senior partner at a major consulting firm, Christa brings over 30 years' experience in general insurance and injury compensation, including roles as Appointed Actuary and advisor to insurers, reinsurers, and government. Career highlights include leading the Australian Priority Investment Approach to Welfare project and guiding financial services clients through post-Royal Commission regulatory challenges. She is passionate about fostering collaboration across sectors to address economic and social issues.

The Hon Dr Daniel Mulino MP, Assistant Treasurer, Minister for Financial Services

Born in Brindisi, Italy, Daniel was a young child when he moved with his family to Australia. He grew up in Canberra and completed his first degrees – arts and law – at the ANU. He then completed a Master of Economics (University of Sydney) and a PhD in economics from Yale. He lectured at Monash University, was an economic adviser in the Gillard government and was a Victorian MP from 2014 to 2018. As Parliamentary Secretary to the Treasurer of Victoria, Daniel helped deliver major infrastructure projects and developed innovative financing structures for community projects. In 2018 he was preselected for the new federal seat of Fraser and became its first MP at the 2019 election, re-elected in 2022 and 2025. From 2022 to 2025, Daniel was chair of the House of Representatives’ Standing Economics Committee in which he chaired inquiries; economic dynamism, competition and business formation and insurers’ responses to 2022 major floods claims. In 2025, he became the Assistant Treasurer and Minister for Financial Services. In August 2022, Daniel published ‘Safety Net: The Future of Welfare in Australia’, which aims to explore the ways in which an insurance approach can improve the effectiveness of government service delivery.

Karan Anand, Chief Strategy Officer and Managing Director, Hnry

Karan Anand is the Global Chief Strategy Officer and Managing Director, Australia at Hnry, with nearly 20 years of experience in strategy, technology and scaling high-growth businesses. As part of Hnry’s three person executive team, he helps shape global strategy and has led the company’s expansion in Australia. Previously a Director at Monitor Deloitte, he advised boards and CEOs across financial services and technology. Karan has been recognised through awards including Commbank’s Young Hero Innovator of the Year and Asialink’s Asian Australian 40 Under 40. He holds a Master of Finance from UNSW and a Bachelor of Commerce in Actuarial Studies and Finance.

Chair: Annette King, Non-Executive Director

Annette King is an experienced company director, former CEO and actuary, with over 35 years’ experience in financial services across Asia-Pacific. Prior to becoming a non-executive director, Ms King had a successful track record as a CEO, CFO and CMO of significant financial institutions, as well as being a founder/entrepreneur. Ms King has served large multi-national companies (Swiss Re, AXA, Manulife, Mercer, MLC Super) and fintech companies (AFG, FNZ, Galileo Platforms). Ms King is the Chair of HCF, and serves as a Non-Executive Director on the boards of TAL, AFG and U Ethical Investors.

Adam Driussi, CEO and Founder, Quantium

Adam Driussi is the CEO of Quantium. He co-founded Quantium in 2002 and today they have grown to employ over 1,200 staff globally, serving major clients such as Woolworths, Telstra, CBA, Qantas and various government departments. Since February 2024, he also serves as the Chairman of the Canterbury-Bankstown Bulldogs Rugby League Club after previously joining the board in 2022. Adam is an actuary and is very passionate about how AI will change the way we work - currently driving that change at both Quantium and the Bulldogs.

Nicolette Rubinsztein AM, Non-Executive Director, Actuary, Author

Nicolette is a non-executive director in the finance industry. She is Chair of CBHS Heath Fund, on the board of Zurich and was previously on the boards of UniSuper, Class and SuperEd. She is also Chair of Greenpeace Australia Pacific and a South African charity committee, Missionvale Australia. In 2024 she was made a Member of the Order of Australia (AM) for her service to business. She was President of the Actuaries Institute in 2019 and was a director of ASFA for eight years. Prior to her board career, Nicolette held senior roles with CBA/ Colonial First State, BT and Towers Perrin. Nicolette is a qualified actuary, holds an executive MBA from the AGSM and is a Fellow of AICD. She is author of the book “Not Guilty”, a guide for career mums. She is married to Jonathan Rubinsztein and they have three daughters.

Brett Clark, CEO and Managing Director, Daiichi Life

Brett Clark is a highly experienced leader in the life insurance industry, currently serving as the Managing Director and CEO of Daiichi Life Asia Pacific Pte. Ltd., where he oversees Dai-ichi Life Group’s strategy, business interests, and regional operations across the Asia-Pacific markets. In addition, he is a Senior Managing Executive Officer at Dai-ichi Life Holdings, playing a key role in shaping the Group’s global strategy. Brett is also a Non-Executive Director at Dai-ichi Life Group Companies in India (Star Union Dai-ichi Life Insurance) and New Zealand (Partners Life), providing governance oversight and strategic direction. Prior to his current role, Brett spent 16 years at TAL Life, the Australian subsidiary of Dai-ichi Life, including nearly a decade as its Group CEO and Managing Director, where he led TAL to become Australia’s leading life insurer, expanding its presence across retail advice, group, and direct to customer insurance. A qualified actuary, Brett has held senior leadership positions at AIG Life and served as Chairman of industry boards, bringing deep expertise in strategy, finance, distribution, and operations across international insurance markets. His extensive experience in executive leadership, corporate governance, and industry transformation positions him as a key figure in the global life insurance sector.

Chair: Simone Leas, General Manager, Advice & Approvals, Australian Prudential Regulation Authority

Simone Leas is a Fellow of the Actuaries Institute and a Graduate of the Australian Institute of Company Directors. As General Manager, Advice & Approvals at the Australian Prudential Regulation Authority, Simone draws on more than 25 years of global experience in risk management, compliance, and capital management. She is passionate about realising the value and competitive edge that come from better decision making in organisations and has authored a book on this topic.

Kenneth Koh, WTW

Kenneth is the regional technology sales leader, Asia Pacific with WTW’s Insurance Consulting and Technology practice, based in Singapore. He is a strong advocator of customer experience and believes strongly in collaboration with client to advance the organization. With more than 25 years of experience in the insurance industry, Kenneth has built, grown and structured insurers to deliver exceptional growth, efficiency using data and analytics. In WTW, his primary role is to provide alternative choices to actuaries on the availability of actuarial software in the market place. He is a fellow, Life Management Institute (FLMI) and has a Masters of Science (MSc) from Nanyang Business School.

Vivian Yu, Acenda

Vivian Yu is an experienced actuary with over a decade of professional expertise spanning areas ranging from technical and operational roles in Valuation and Wealth Management through to product development in both the investment and life insurance sectors. She is passionate about creating better financial protections for all Australians who are in retirement or approaching retirement. Her latest adventure is working as senior manger in the pricing team of Acenda. Her role sees her carrying out research, development and implementation of innovative ideas to make life insurance, one of the oldest financial products, more relevant in the contemporary context and in meeting the ever changing needs of Australian customers.

Jason Gordon, Deloitte

Jason is an actuary with over 20 years of experience, primarily in the life insurance sector across traditional valuation and pricing roles as well as risk management. He is currently a Director in Deloitte's Assurance.

Ean Chan, EY

Ean is a Senior Manager within EY's Actuarial Services team, with experience in Life Insurance, Data Analytics and AI, primarily concentrating on Health and Human Services clients. As chair of the Institute's Young Data Analytics Working Group and member of the Data Science and AI Practice Committee, Ean is dedicated to driving progress in the actuarial field by augmenting our expertise with the latest data science, AI and machine learning methodologies.

Meg Yang, Finity

Meg Yang is a Fellow of the Actuaries Institute and volunteers as the Deputy Chair of the Young Data Analytics Working Group and member of the Data Science and AI Practice Committee. In her role as a consultant at Finity Consulting, she is passionate about harnessing cutting‐edge AI tools to deliver innovative, practical solutions that tackle everyday challenges in the general insurance space.

Yige Wang

Yige is an actuarial professional (FIAA, CERA) with broad experience spanning actuarial practice, analytics, and strategic planning. As an Actuarial Manager at Zurich Australia, she applies data-driven insights to guide business decisions and improve customer outcomes, including predictive modelling and financial analysis to support executive strategy. Most recently, Yige completed a secondment with Zurich Japan’s General Insurance team, further expanding her international perspective and deepening her appreciation for cross-market collaboration.

Lachlan Clark

Lachlan Clark is an actuary with experience spanning a wide range of positions across Australia in both insurance and data analytics. His current role focuses primarily on General Insurance and data analytics projects, where he applies actuarial approaches in both traditional and emerging areas. Lachlan has worked across a wide range of areas including climate risk, banking, workforce and supply chain modelling as well as in reserving and pricing roles for a variety of general insurers both domestic and internationally including supporting audit and appointed actuary roles. He brings a practical, data-driven approach to addressing emerging risks and challenges in the industry.

Portia Elliott

Sharanjit Paddam, Finity

Olivia Brodhurst, Finity

Olivia Brodhurst is a climate consultant with over 20 years of experience in environmental science and climate risk management. She has led initiatives to assess and mitigate climate-related risks, focusing on understanding potential impacts under the range of climate scenarios and utilising this information to enhance resilience. Olivia has experience working at multiple levels of Government, non-government and in the private sector. Olivia is recognised for her ability to engage and educate to influence change, integrate climate risk considerations into strategic decision-making processes, leading towards more holistic and resilient solutions.

Kate Cotter, Resilient Building Council

Kate Cotter is the founder and CEO of the Bushfire Building Council of Australia, which she established in 2014 to adapt the 2 million Australian homes most vulnerable to extreme weather. Kate's vision is to break the preventable, unsustainable disaster-recovery cycle through programs that accelerate effective adaptation of the built environment.

Sachini Wijesena, Allianz

Sachini is a qualified Fellow of the Institute of Actuaries Australia (FIAA) and a Chartered Enterprise Risk Actuary (CERA). She has 10 years of experience in the General Insurance industry. She is passionate about the industry’s dynamic challenges and opportunities, including managing climate change, regulatory change and the potential of big data. Currently she works for one of largest general insurers in Australia, Allianz. In her current role she uses actuarial techniques and analytics to develop predictive models in the areas of claims costs, conversion rates and customer demand to unlock key pricing insights from data. She holds a double degree in Actuarial Studies and Applied Finance at Macquarie University. Currently she is a PhD student at the University of Technology Sydney. Her main research areas lie within developing an actuarial framework for design and pricing of Weather Index Insurance (WII) products to improve the viability of WII product as an effective and innovative risk management tool. This will enable farmers to have effective income protection against extreme weather events, empowering investment in technology and ultimately improving productivity for the agricultural industry.

Biswajeet Pradhan

Distinguished Professor Biswajeet Pradhan is an internationally established scientist in the field of Geospatial Information Systems (GIS), remote sensing and image processing, complex modeling/geo-computing, machine learning, and soft-computing applications, natural hazards and environmental modeling, and remote sensing of Earth observation. He is also a distinguished professor at the University of Technology, Sydney. He is listed as the world’s most highly cited researcher by Clarivate Analytics Report for five consecutive years: from 2006 to 2020, he was one of the world’s most influential minds. From 2018 to 2020, he was awarded a World Class Professor position by the Ministry of Research, Technology, and Higher Education, Indonesia. He is a recipient of the Alexander von Humboldt Research Fellowship from Germany. In 2011, he received his habilitation in “Remote Sensing” from Dresden University of Technology, Germany. Between February 2015 and February 2022, he served as “Ambassador Scientist” for the Alexander Humboldt Foundation in Germany. Professor Pradhan has received 55 awards since 2006 in recognition of his excellence in teaching, service, and research. Out of his more than 832 articles (Total Citation: 85,634, H-index: 149, i10-index: 744), more than 770 have been published in Science Citation Index (SCI/SCIE) technical journals. He has written 12 books and 70 book chapters. He has completed 23 research projects, amounting to US$ 14 Million. He is a member of many international professional bodies such as the Committee of Space Research (COSPAR), Senior Member of IEEE, United Nations Outer Space Research Programme (UNOOSA), and many more. He sits as a board member of many national programs in Southeast Asia. He is a regular reviewer for many international bodies, alike the European Science Foundation, the Dutch Research Council, the Austrian Science Foundation, the Research Council UK (RCUK), the Swiss National Science Foundation, the Belgian Remote Sensing Program, and many more. He is the Associate Editor and Editorial Member for more than 10 ISI journals. He has delivered 35 keynote and invited talks at international conferences. He has edited and reviewed more than 3300 articles. He has supervised 55 Ph.D. students, 12 MSc students (with thesis), and 30 MSc students by coursework.Prof. Pradhan has developed a strong research network internationally with organizations and universities in Malaysia, Germany, Norway, the Netherlands, Vietnam, Turkey, Thailand, South Korea, Mexico, Egypt, Canada, Iran, and Indonesia. Professor Pradhan has widely travelled abroad, visiting more than 55 countries to present his research findings.

Queenie Chow, Milliman

Queenie calls herself an “actuary without borders” – a passionate actuary working in global development and inclusive insurance. Queenie works with the MicroInsurance Centre at Milliman as Senior Program Director leading the UNDP-Milliman Global Actuarial Initiative (GAIN) which focuses on building the actuarial profession in more than twelve low-middle income countries across Africa, Asia and Latin America. Inspired to make insurance accessible to all, Queenie has previously worked with the Impact Insurance Facility of the United Nation’s International Labour Organization across countries inclusive of Kenya, Togo, China and Philippines etc. She is an Australian-qualified actuary with over 15 years of experience working in consulting and has been working within the microinsurance innovation space. Queenie was recently given the “40 under 40: most influential Asian-Australian Awards.

Xiao Xu, UNSW

Dr. Xiao Xu is a Senior Lecturer and Nominated Accreditation Actuary in the School of Risk and Actuarial Science at the University of New South Wales (UNSW), Australia, and serves as the International Research Manager at the Society of Actuaries (SOA). Her research interests focus on variable annuities, risk management, and deep learning. At the SOA, she is responsible for managing research projects and conducting studies across the APAC region. Before joining UNSW in 2020, Xiao had years of industry work experience in life insurance, consulting business and VC entrepreneurship. She earned her PhD at UNSW, an MSE from Johns Hopkins University, and a BBA from the University of Wisconsin-Madison. Xiao also holds several professional qualifications, including Chartered Financial Analyst (2019), Chartered Accountant - Australia (2019), Fellow of the Institute of Actuaries of Australia (2018), Certified Public Accountant - USA (2018), Financial Risk Manager (2016), Fellow of the Society of Actuaries (2015), and Chartered Enterprise Risk Analyst (2015).

James Aclis, KPMG

James Aclis is a qualified FIAA and CERA with over 12 years of experience in general insurance. He has worked in NZ, the UK, and Saudi Arabia, with experience in valuations, modelling, analytics, and risk. James has performed reviews of the ICAAP and ORSA for over a dozen general insurers and private health insurers, and is the co-author of the KPMG General Insurance Industry ICAAP survey, General Insurance Industry Recovery Plan survey, and Private Health Insurance ICAAP & Recovery Plan surveys. James has also advised numerous non-insurers on their risk management, approach to and management of insurance, and consideration of mutual, captive, and other alternative risk solutions.

Grace Ng

Stuart Jones

Rob Deutsch