Reinsurance Explained: A Pillar of Strength for General Insurers

A Dialogue Paper providing a comprehensive outline of reinsurance, the insurance bought by insurers to protect against major losses.

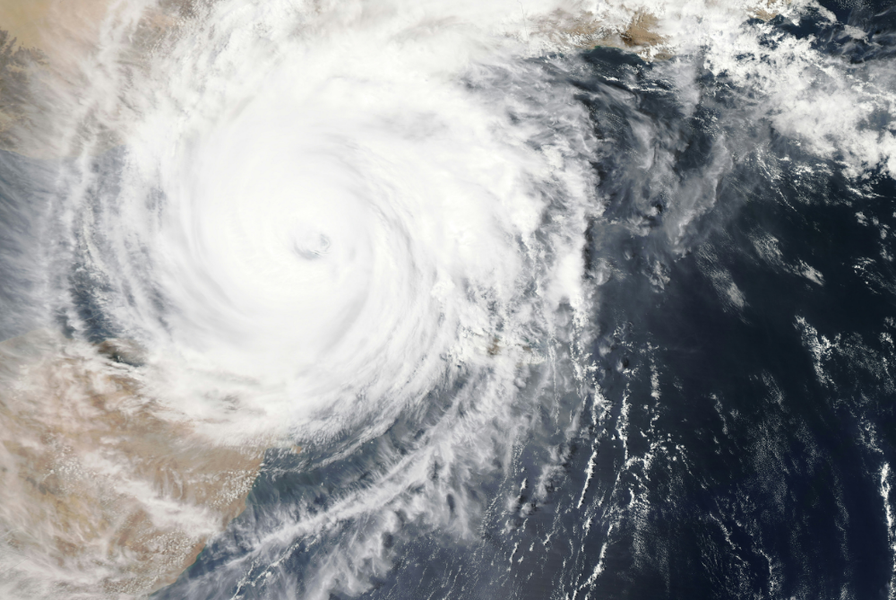

With natural disasters becoming more frequent and severe, the paper explains why reinsurance is a critical mechanism for insurance affordability.

In Reinsurance Explained: A Pillar of Strength for General Insurers, Chief Actuary Kate Bible outlines why reinsurance matters to every Australian consumer and how recent global changes are reshaping the landscape.

The capital relief that reinsurance provides insurers, along with the stability of returns to their investors, represents the difference between an insurance market that can serve consumers affordably and one that may become inaccessible to many consumers.

— Kate Bible, FIAA

In brief:

- Spending an estimated AUD 2.5 billion on reinsurance last year saved general insurers from needing up to AUD 70 billion in extra capital to cover natural disasters and other losses.

- Secondary perils — severe thunderstorms, floods, droughts, wildfires and landslides — now cause more total global damage than primary perils such as hurricanes and earthquakes.

- Climate change, population growth and rising rebuilding costs are fundamentally reshaping insurance costs across the industry.

- Compared to their global peers, Australian insurers have fewer reinsurance options that receive regulatory credit, with APRA currently consulting on expanding access to alternative solutions.

Why this matters now

With global insured losses from natural disasters reaching USD 145 billion in 2024, and Australia experiencing AUD 8.3 billion in insured losses understanding how reinsurance works has never been more critical for consumers, policymakers and industry professionals.

About the author

Kate Bible

Kate Bible is a Fellow of the Actuaries Institute and has over 23 years of experience across regulation, insurance and reinsurance. She is currently Chief Actuary and Head of Capital for Aon's Reinsurance Solutions in Australia and New Zealand. Prior to Aon, Kate spent 13 years at the Australian Prudential Regulation Authority (APRA) in roles spanning policy development, supervision and industry analysis.

Dialogue Papers are a series of papers written by actuaries and published by the Actuaries Institute which aim to stimulate discussion on important, emerging issues. Opinions expressed in this publication are the opinions of the Paper’s author and do not necessarily represent those of the Institute.

Be informed. Stay ahead. Subscribe.